Common Reasons for Deductions/Disqualifications – Massachusetts

$ 10.00 · 5 (605) · In stock

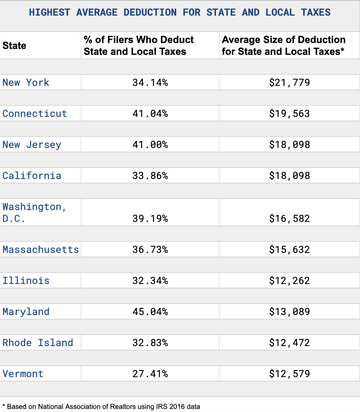

States take feds to court with 'creative arguments' over the SALT cap

The SALT Deduction + SALT Deduction Fairness Act / H.R. 2555 - Austin CPA Firm, Millan & Co. PC

How to Claim the Medical-Expense Deduction on Your Taxes

Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions

Common Reasons for Deductions/Disqualifications – Massachusetts Kayak Bassin

Alabama Retainage in Construction - FAQs, Guide, Forms, & Resources

What Are ESOPs and MEWAs and Why Might They Trend in Cannabis? - Cannabis Business Times

Massachusetts State Income Tax: Insights and Filing Tips 202

2022 Living Wage Report by The University of Scranton - Issuu

Richard Friedman, Author at Richard Friedman

Sales Tax Holidays - The CPA Journal

Section 280a Deduction: Renting Your Personal Home to Your Business

“Compromises” Under Discussion for the State and Local Tax Deduction Do Not Fix Flawed Tax Bills – ITEP